Advanced Financial and Business Modeling for Growth, Turnaround, and Recovery

Carl Seidman

FP&A Advisor | Microsoft MVP in Excel

Build Smarter Models. Guide Stronger Decisions. And Shape Better Outcomes...

In this exceptionally interactive, roll-up-your-sleeves immersive modeling experience, you will transition from a traditional financial analyst to a strategic financial modeler and advisor. You will be capable of building sophisticated and dynamic integrated Excel models that capture the intricacies of FP&A and business operations.

This next-level journey will walk you through the step-by-step methods for data acquisition, model structuring, and building integrated 3-statement financial and operating models. It focuses on modeling for performing and underperforming businesses, not investment banking transactions. You'll learn & apply the principles that experienced management consultants and FP&A leaders use in financial and operational business modeling.

Whether you are a financial analyst, Controller, Director of FP&A, or CFO, you will build greater confidence, higher-level modeling, and critical thinking skills. While other financial training mostly focuses on model-building, how financial statements connect, and plugging in numbers from super-clean data, this program will walk you through real-life scenarios and the strategic considerations you'll be making in your work.

What you’ll learn

📈 Build powerful and traceable financial models that enable you to make strategic business decisions and optimize business outcomes.

Ensure your model remains flexible and maintainable, even as complexity grows or the business pivots

Embed error checks, documentation, and governance so your model becomes a trusted tool and not an unwieldy collection of spreadsheets.

Establish best-practice model standards: clear assumptions, consistent formatting, and version control

Tie together operational assumptions, sales forecasts, financing events, and investment decisions to each statement seamlessly

Construct a flexible structure that accommodates performing and under-performing company dynamics

Assemble the Income Statement, Balance Sheet and Cash Flow statement in a unified workbook

Break down key operational, financial and strategic drivers influencing business growth, distress, and revitalization

Identify under-performance symptoms early (e.g., cash-flow stress, margin erosion, leverage spikes)

Translate financial analysis and performance diagnostics into modeling assumptions that reflect either growth or turnaround scenarios

Move beyond numbers: craft a narrative around “what the model shows” and “so what we should do.”

Identify key decision-points, break-even thresholds, quantification of working capital changes, and strategic choices surfaced by the model

Communicate results clearly to non-technical executives and influence meaningful outcomes

Translate financial analysis for non-financial teams like operations, marketing, human resources, capital investment planning, and sales

Collaborate cross-functionally to connect model insights to strategic execution

Build trust and influence with leadership and investors through financial clarity that can be easily drilled down into supporting data

Use Power Query and advanced formula logic to automate and streamline forecasting

Apply dynamic arrays, advanced lookups, and modern functions to save time, eliminate mistakes, and minimize rework

Incorporate error handling, dynamic ranges, and intuitive toggles for flexible scenarios

Who this course is for

Aspiring financial analysts seeking to develop advanced modeling skills for career growth in finance, investments, and banking.

Corporate finance professionals seeking to build robust financial models to support strategic planning, capital raises and allocations.

CFOs and finance leaders looking to elevate their team's capabilities in financial modeling for strategic planning and value creation.

Prerequisites

Finance or FP&A Experience (2+ Years)

You should understand budgeting or forecasting basics. It ensures you're ready to apply real-world judgment, not just formulas.

Comfort Working in Excel

You’ll be building real models, so you'll need foundational (not expert) skills to follow along and focus on structure, not just syntax.

Basic Financial Statement Knowledge

You don't need to be an expert in accounting, but should recognize how income, cash flow, and balance sheets connect.

What's included

Live sessions

Learn directly from Carl Seidman in a real-time, interactive format.

12 months access

Go back to course content and recordings whenever you need to.

Community of peers

Stay accountable and share insights with like-minded professionals.

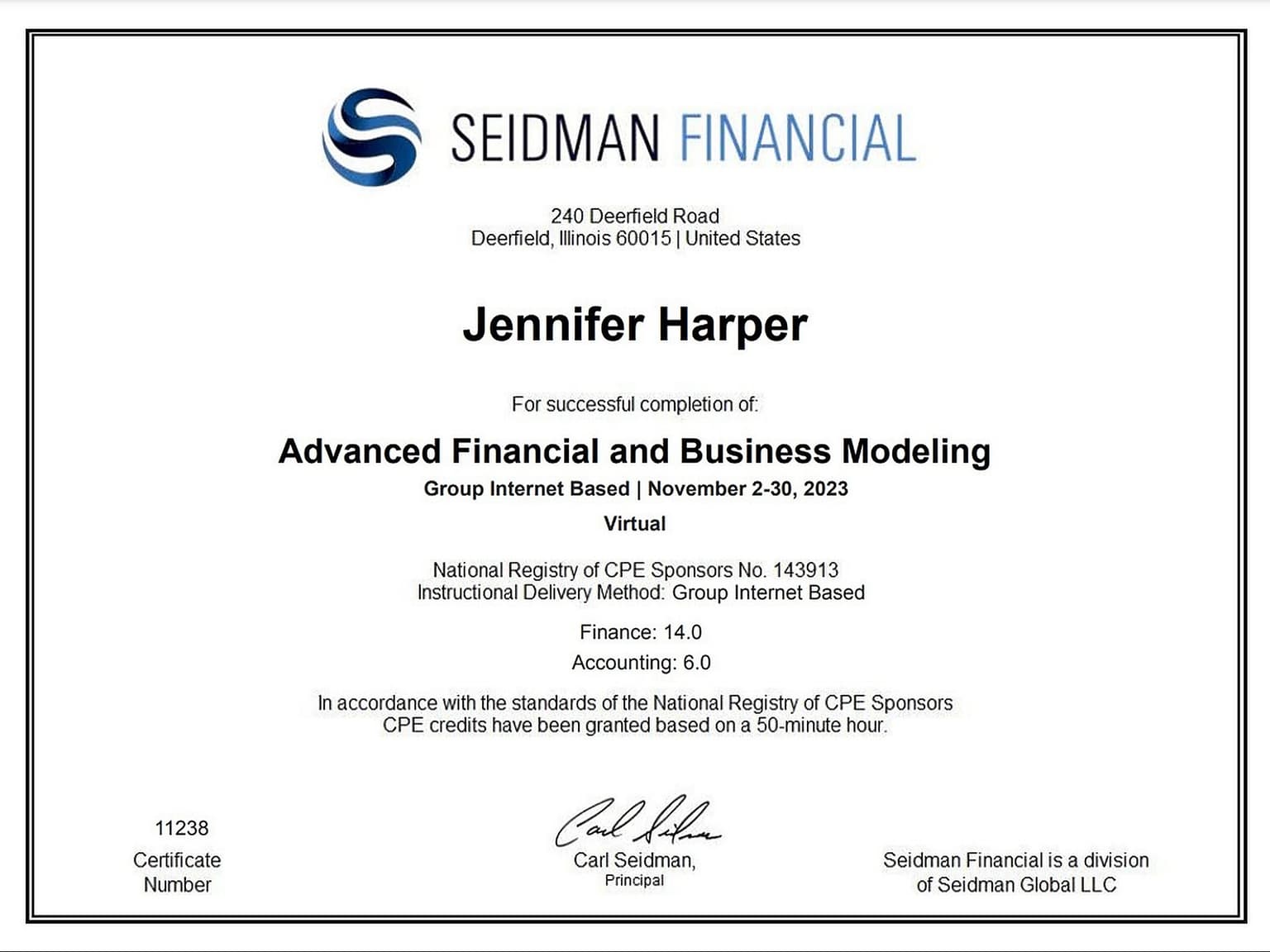

Certificate of completion and CPE

Share your new skills with your employer or on LinkedIn. Receive a second certificate verifying your earning of CPE credits.

Access to the Seidman Financial Digital Vault

Sign up 3 weeks before the live cohort and you may request complimentary access to program recordings through our digital vault. This means you can go through the course at your own pace in advance and then join the live program, when it begins, for reinforcement of the lessons. Contact us at info@seidmanfinancial.com to learn more.

Maven Guarantee

This course is backed by the Maven Guarantee. Students are eligible for a full refund up until the halfway point of the course.

Course syllabus

Week 1

✨ Adv Financial and Business Modeling - LIVE Session (Tues, Jan 13 | 9am CST) ✨

Module 1: Introduction to Integrated Financial Statements and Business Modeling

✨ Adv Financial and Business Modeling - LIVE Session (Fri, Jan 16 | 9am CST) ✨

Module 2: Understanding Modeling Objectives and Initiating Document Requests

Week 2

✨ Adv Financial and Business Modeling - LIVE Session (Tues, Jan 20 | 9am CST) ✨

Module 3: Financial Model Structuring and Best Practices

✨ Adv Financial and Business Modeling - LIVE Session (Fri, Jan 23 | 9am CST) ✨

Module 4: Preparing to Build the 3-Statement Financial Model

Free resource

.jpg&w=768&q=75)

Advanced FP&A: Financial Modeling with Dynamic Excel

Build Extremely Flexible Self-Updating Models

Create adaptable models that update instantly as assumptions shift and as new data is added. Stop wasting time w/updates

Automate with Dynamic Arrays

Replace manual formulas with powerful functions that scale by themselves. Learn the power of SEQUENCE, DROP, and TAKE

Strengthen FP&A Insights for Your Business Partners

Translate complex data into trend analysis, visualize the output and provide clear, actionable analysis for leaders.

Schedule

Live sessions

2-4 hrs / week

We meet live 2x per week. Each session is 2 hours with one 8-10 minutes break. We often have an extended Q&A at the end of each core learning session. Meetings are recorded for future review and reinforcement. In the event you miss a live session, the recordings are there for you to watch/listen to on your own time and at your own pace.

Reinforcement

1 hr / week

Live sessions are full of rich content, demonstrations, instruction, and exercises. While you are not required to complete projects on your own, you are STRONGLY ENCOURAGED to revisit the working files and go through the files/exercises on your own time. This reinforces concepts and ensures that the learning sticks.

Asynchronous content

1 hr / week

All live sessions are recorded and uploaded, usually with 24 hours of the conclusion of the live session, for your continued access. Attendees of The FP&A Mastery Signature Program (of which Advanced Financial and Business Modeling is a component) have access to 100+ hours of recorded learning, discussions, exercises, cases, and Q&A.

Testimonials

- I think Carl did a fantastic job in the training and leaving a usable, easy to reference template that includes most of the baseline topics you run into when modeling. I enjoyed the training and took away many valuable lessons and tips.

John Christian

Restructuring Analyst at Conway MacKenzie - This program was very detailed and hands-on compared to other training programs I have attended.

Rachael Kuehn

Senior Associate at Conway MacKenzie - Very logical structure, highly relevant to work we do at the firm. Carl articulately lays out the process of modelling and is an engaging speaker. It was excellent based on the actual work we do in restructuring.

Harry Bramson

Restructuring Advisor - I think it provides a very strong foundation in model formatting and hygiene. This was much more applicable than the Austin based modeling training.

Conor Flynn

Restructuring at BRG - This was my first training of this this type and this was excellent! The way that Carl set up the files and allowed us to check our work and also not fall behind if we missed a section or had an error was great. The training was very hands on applicable to my job.

Christy Roper

Turnaround and Restructuring Analyst - This was a very complete program, although I would like to see more practical cases for other different types of industries. Extremely important for people to take to improve the quality of their work.

Raphael Di Napoli

Managing Director, Turnaround & Restructuring

What Carl has to say about the Program in his own words

Advanced Financial and Business Modeling with Carl Seidman

Students receive a certificate and 20.0 continuing professional education (CPE) credits for completing the course.

Seidman Financial is registered with the National Association of State Boards of Accountancy (NASBA)