Cash Flow Forecasting and Modeling - Level 1

Carl Seidman

FP&A Advisor | Microsoft MVP in Excel

Nothing's more vital than knowing where cash is coming from & where it's going.

It’s vital to understand the finances of your business, the causes of cash bleeding, and remedies for improving working capital.

In this program -- one of the highest-rated corporate finance courses on Maven -- attendees will discover the various causes of cash flow constraints and how to address them, learn the step-by-step process for building a direct approach 13-week cash flow forecast model, and integrate it with a longer-term financial forecast.

They didn't teach this in your MBA

They don't teach this at your company

They aren't teaching it in public training

It's not just about Excel modeling. It's about critical thinking and strategic planning. That's why management consulting firms, turnaround/restructuring shops, Big 4 advisory, and Fractional CFOs engage Carl as their go-to facilitator for teaching these same techniques to their teams and clients.

This program is geared toward professionals in corporate finance, private equity (PE), financial planning & analysis (FP&A), turnaround and restructuring, and distressed investing. Don’t wait for cash flow challenges to arise. The time to learn how to manage them is now.

What you’ll learn

Learn the step-by-step approach to weekly cash flow modeling, helping healthy companies grow and getting troubled companies back on track.

Dive into the mechanics of model-building and understand operating drivers behind distress and revitalization

Learn what effective cash management and presentation means for various stakeholders including: CFOs, private equity, and FP&A teams

Determine what's causing cash bleeding, prioritize and offer promising courses of action, and challenge yourself with live exercises

Build a short-term cash flow forecast from the ground up, constructing weekly receipts/payments lines to reflect sales, AR, AP and payroll

Understand the nuances of operating expenses, accrued expenses, payroll, capex, financing, and all balance sheet roll-forwards

Use the cash flow tool to back into operational drivers that can be influenced in partnership with operations, sales, marketing, and HR

Establish formulaic integration with underlying financial data, employing clean-but-powerful Excel functionality

Build supporting schedules that connect raw accounting and financial data with the dynamic model

Establish recurring processes for efficient cash flow updating, forecasting and reforecasting

Position your short-term cash-flow model for integration with a three-statement financial model or balance sheet forecast

Ensure accrual-to-cash alignment so monthly assumptions in sales, costs, and working capital tie to your weekly cash-flow forecast

Create linkages between near-term cash model outcomes and longer-term strategic initiatives (e.g., growth or turnaround)

Build in error-checks, scenario toggles and modular design to increase model reliability

Document assumptions, version control model files, and maintain audit-friendly architecture

Develop a scalable model process, using smart formulas and dynamic arrays, that support updating, re-forecasting, and roll forwards

Use Excel functions and techniques including dynamic ranges, SUMIFS, structured references, and data mapping to automate forecasts

Build logic for timing of cash flows (lags, seasonality, accruals), and create easy-to-use input interfaces.

Apply best-practice modeling standards, auditable worksheets, assumptions to make your model user-friendly and resilient

Who this course is for

Finance and accounting professionals with a responsibility for cash flow forecasting, liquidity management, and working capital.

Finance professionals working in management consulting, turnaround, restructuring, bankruptcy, M&A, and corporate development.

CFOs, Directors of Finance, Controllers, business owners, AR/AP analysts and clerks, FP&A analysts.

Prerequisites

Finance or FP&A Experience (2+ Years)

You should understand budgeting or forecasting basics. It ensures you're ready to apply real-world judgment, not just formulas.

Comfort Working in Excel

You’ll be building real models, so you'll need foundational (not expert) skills to follow along and focus on structure, not just syntax.

Basic Financial Statement Knowledge

You don't need to be an expert in accounting, but should recognize how income, cash flow, and balance sheets connect.

What's included

Live sessions

Learn directly from Carl Seidman in a real-time, interactive format.

12 months access

Go back to course content and recordings whenever you need to.

Community of peers

Stay accountable and share insights with like-minded professionals.

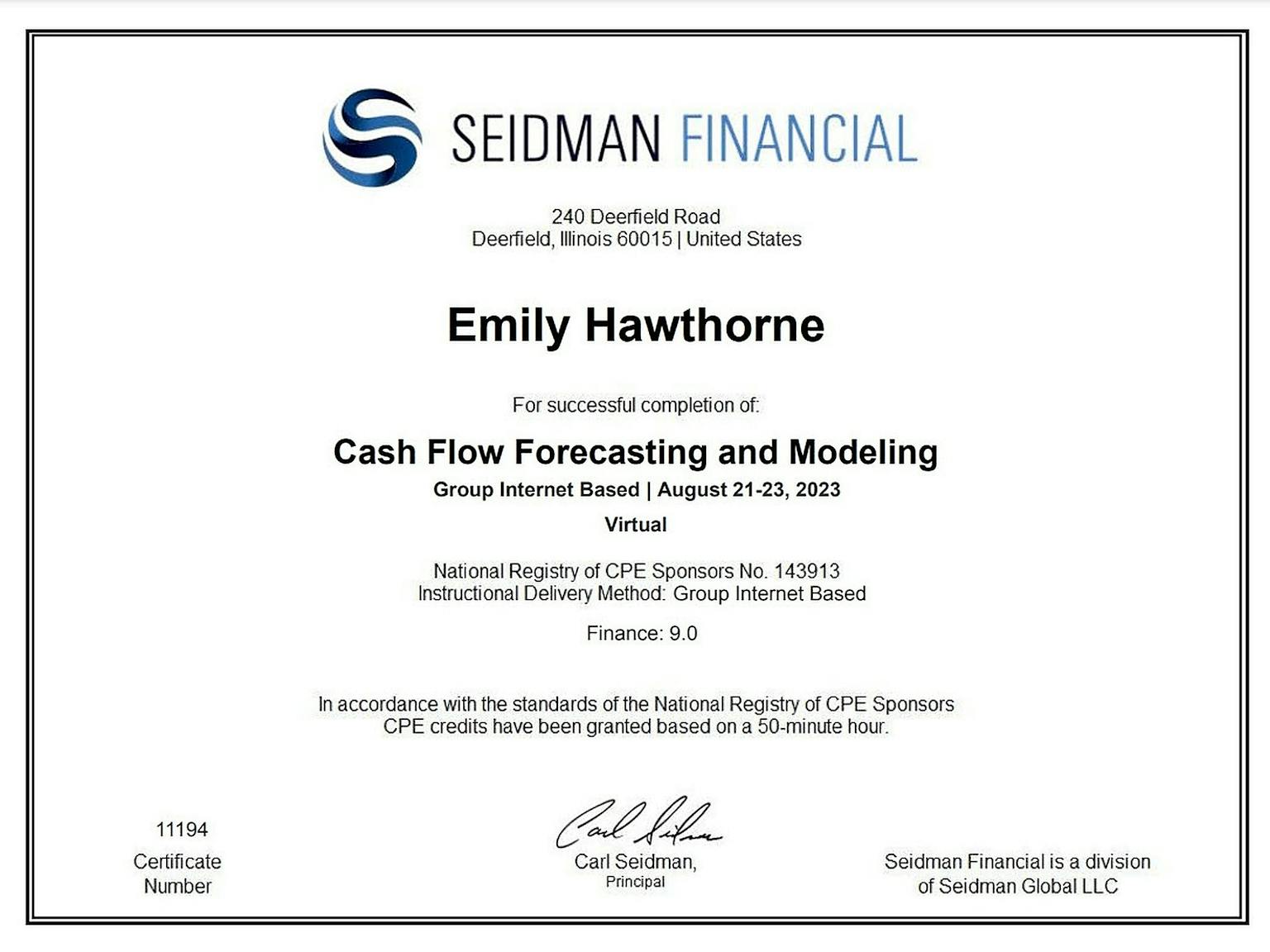

Certificate of completion and CPE

Share your new skills with your employer or on LinkedIn. Receive a second certificate verifying your earning of CPE credits.

Access to the Seidman Financial Digital Vault

Sign up 3 weeks before the live cohort and you may request complimentary access to program recordings through our digital vault. This means you can go through the course at your own pace in advance and then join the live program, when it begins, for reinforcement of the lessons. Contact us to inquire.

Contact us at:

info@seidmanfinancial.com

Maven Guarantee

This course is backed by the Maven Guarantee. Students are eligible for a full refund up until the halfway point of the course.

Course syllabus

Week 1

✨ Cash Flow Forecasting and Modeling: LIVE Session (Time TBD)✨

Module 1: Structuring the Cash Flow Model - Design and Structure

Module 2: Financial Reports, Statements, and Data Collection

✨ Cash Flow Forecasting and Modeling: LIVE Session (Time TBD)✨

Module 3: Forecasting Operating Cash Receipts

Week 2

✨ Cash Flow Forecasting and Modeling: LIVE Session (Time TBD)✨

Module 4: Forecasting Operating Cash Disbursements

✨ Cash Flow Forecasting and Modeling: LIVE Session (Time TBD)✨

Module 5: Forecasting Non-Operating Cash Disbursements

Free resource

Dynamic Modeling for Cash Flow Forecasting

Build dynamic, recurring templates

Dynamic modeling means being able to update data and assumptions without overhauling your model. You'll learn how.

Powerful Excel functionality

Powerful and robust functionality doesn't need to be advanced. You'll get ideas of what formulas to use.

Use assumptions to drive the cash flow forecast

Supporting schedules should drive the fuller cash flow model and be easy to update. You'll see how this works.

Schedule

Live sessions

2-4 hrs / week

We meet live 2x per week. Each session is 2 hours with one 8-10 minutes break. We often have an extended Q&A at the end of each core learning session. Meetings are recorded for future review and reinforcement. In the event you miss a live session, the recordings are there for you to watch/listen to on your own time and at your own pace.

Reinforcement

1 hr / week

Live sessions are full of rich content, demonstrations, instruction, and exercises. While you are not required to complete projects on your own, you are STRONGLY ENCOURAGED to revisit the working files and go through the files/exercises on your own time. This reinforces concepts and ensures that the learning sticks.

Asynchronous content

1 hr / week

All live sessions are recorded and uploaded, usually with 24 hours of the conclusion of the live session, for your continued access. Attendees of The FP&A Mastery Signature Program (of which Cash Flow Forecasting and Modeling is a component) have access to 100+ hours of recorded learning, discussions, exercises, cases, and Q&A.

Testimonials

- I wanted to express my sincere appreciation for the cash flow forecasting and modeling course. Your expertise, clear explanations, and practical approach made the learning experience highly valuable. The course materials and resources provided were comprehensive and aided in reinforcing the concepts.

Ahmad Zeidan

Finance Manager, United Medical Supplies LLC - Each person in a decision making capacity should take the time to have an understanding of how a cash flow forecast model is created and what goes into it. Comprehension and transparency are key factors to effective decision making whether scaling or getting a company back on track which is why I would highly recommend this course to my network.

Mark Kennedy

Turnaround and Restructuring Advisor

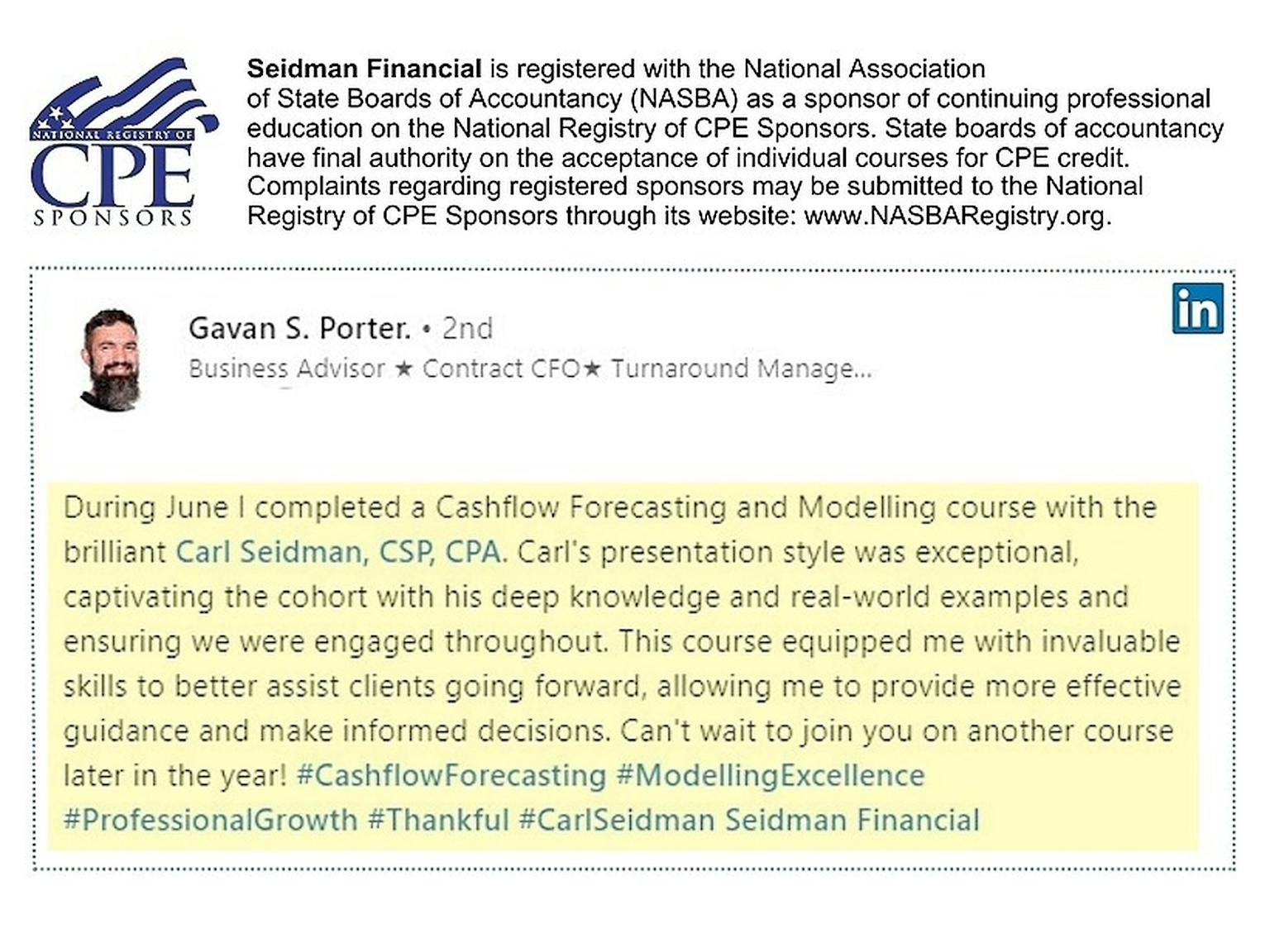

This program is CPE-eligible for up to 10 hours of continuing education credits

Source: Linkedin.com

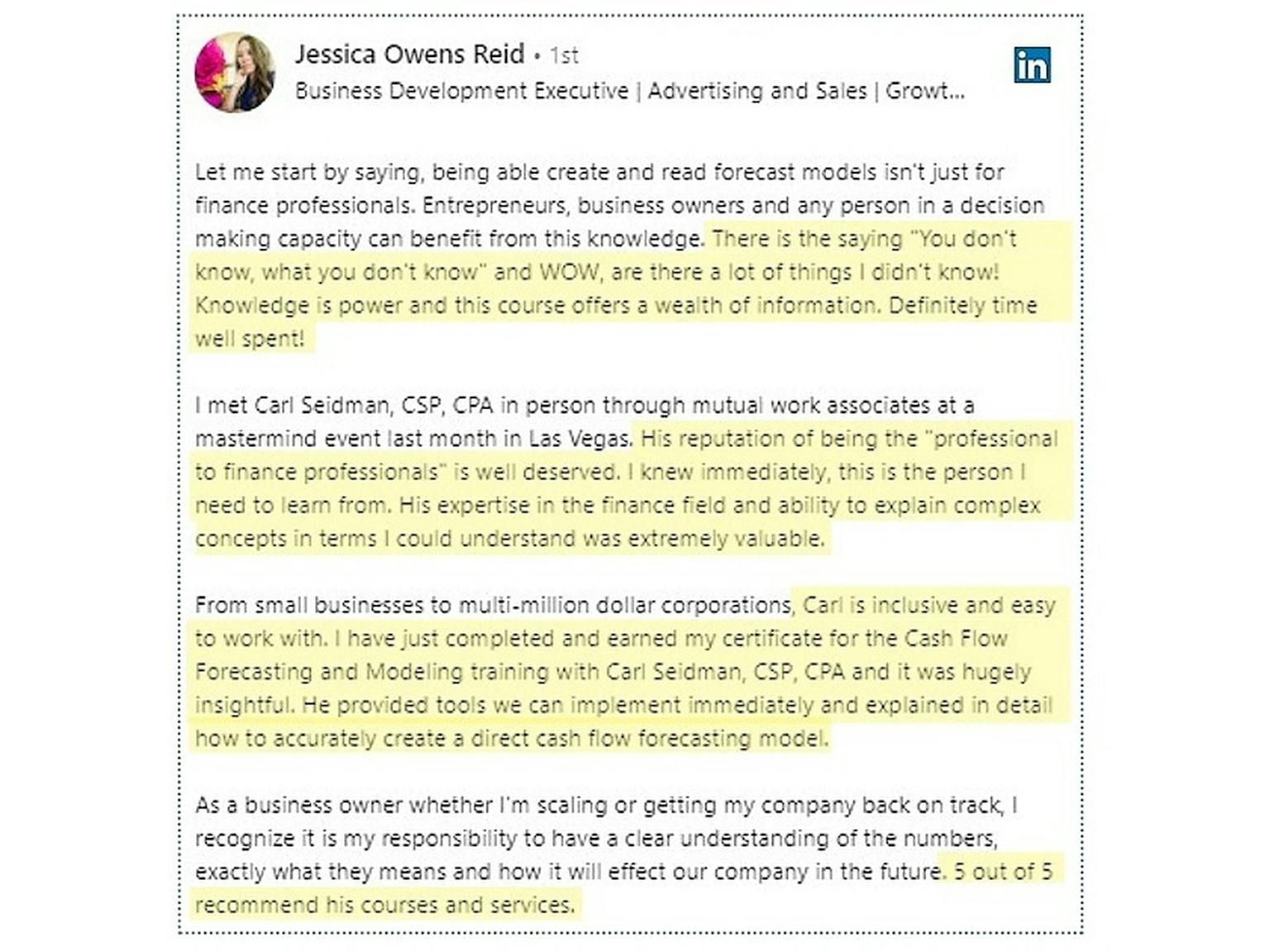

What attendees of Cash Flow Forecasting and Modeling have to say:

Source: Linkedin.com

What attendees of Cash Flow Forecasting and Modeling have to say:

Students receive a certificate of completion and up to 10.0 CPE credits

Certificate of Completion: Cash Flow Forecasting and Modeling

What makes this program so different from every other cash flow course out there

What Happens After Programs Conclude

Frequently asked questions

Contact Us:

$1,200

USD