Vision Investing - Beating The Market & Changing the World

Eugene Ng

Invest. Beat Markets. Change the World.

Vision Investing, Invest Better with Purpose.

Learn from an actual practitioner, an experienced individual investor who has continued to beat the markets, despite numerous market selloffs, who is now professional investor.

Master the science and art of investing in stocks. Understand and focus on owning massive winning companies. Let outsized multi-bagger returns drive your investing outperformance.

What you’ll learn

Learn how to generate outsized long-term returns and life-changing wealth by investing in winning stocks that reflect your purpose & values.

Spot exceptional companies before the market does. Learn to distinguish temporary winners from enduring compounders worth holding forever.

Develop the analytical rigor to invest with confidence. Understand why quality beats quantity and how to size positions that matter.

Ignore noise, focus on what compounds. Discover how patience and conviction in great businesses create wealth that trading never will.

Master analyzing competitive moats, unit economics, and sustainable advantages. Understand what makes companies truly durable.

Learn when to buy excellence, add to excellence, and sell mediocrity. Understand market cycles without being controlled by them.

Transform from reactive trader to purposeful investor. Build a portfolio that reflects your vision and compounds wealth while you sleep.

Learn directly from Eugene

Eugene Ng

Author, Vision Investing, Founder and Managing Partner, Vision Capital Fund.

Who this course is for

You want to be richer, to learn how to properly invest in stocks to build, grow and compound life-changing financial wealth over many years.

You want to be smarter, to build your own investing framework to find the best businesses to own for the longest time, and to keep learning.

You want to be happier, to spend time on your other passions & dreams, and not be affected by constantly moving prices, and noisy headlines.

What's included

Live sessions

Learn directly from Eugene Ng in a real-time, interactive format.

Lifetime access

Go back to course content and recordings whenever you need to.

Community of peers

Stay accountable and share insights with like-minded professionals.

Certificate of completion

Share your new skills with your employer or on LinkedIn.

Maven Guarantee

This course is backed by the Maven Guarantee. Students are eligible for a full refund up until the halfway point of the course.

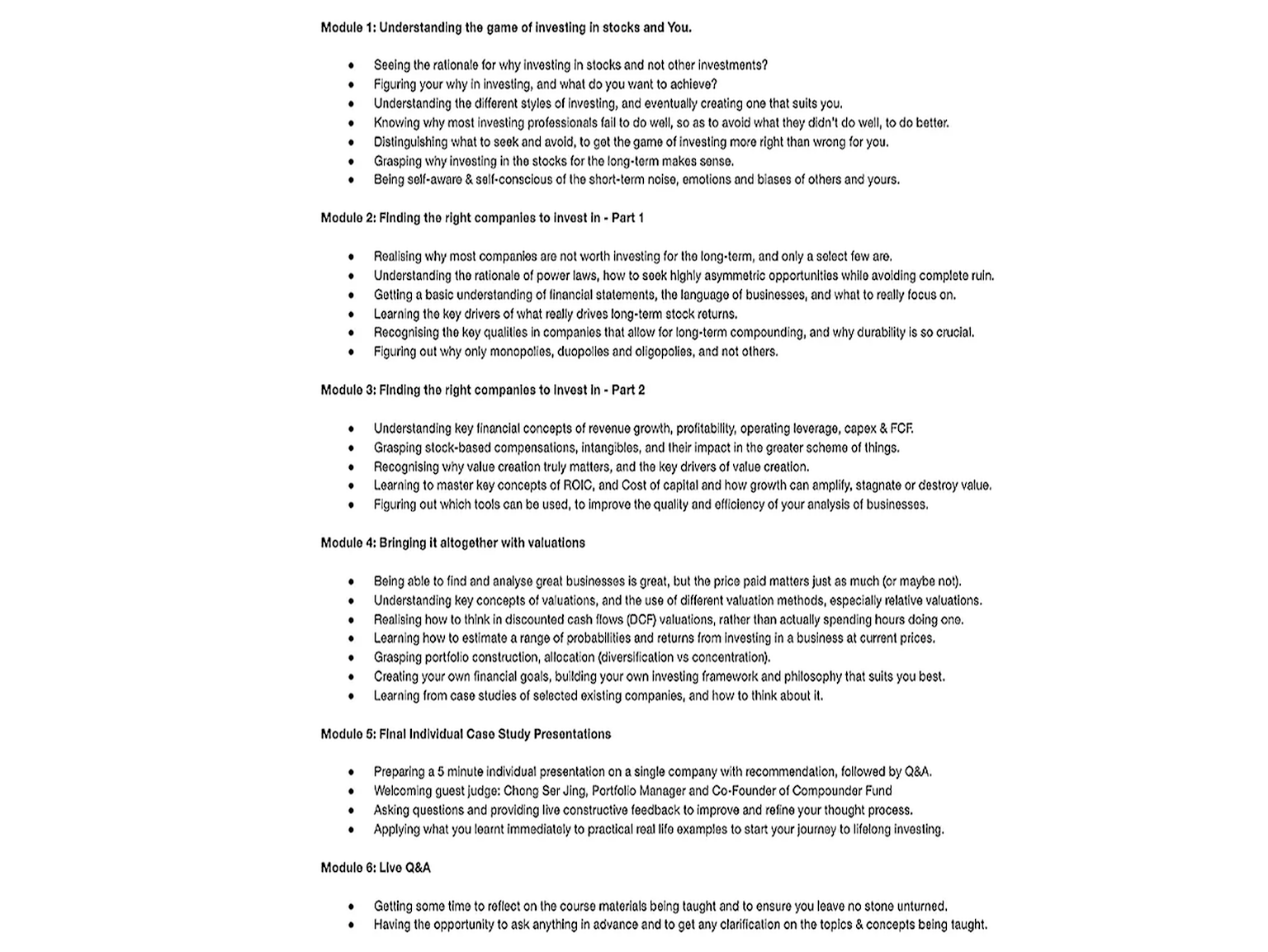

Course syllabus

Week 1

Mar

2

Vision Investing Module 1: Understanding the game of investing in stocks and you

Mar

4

Vision Investing Module 2: Finding the right companies to invest in - Part 1

Mar

6

Vision Investing Module 3: Finding the right companies to invest in - Part 2

Week 2

Mar

9

Vision Investing Module 4: Bringing it altogether with valuations

Mar

11

Vision Investing Module 5: Final Individual Case Study Presentations

Mar

13

Vision Investing Module 6: Live Q&A

Schedule

Live sessions

6 hrs / week

Mon, Mar 2

12:00 PM—3:00 PM (UTC)

Wed, Mar 4

12:00 PM—3:00 PM (UTC)

Fri, Mar 6

12:00 PM—3:00 PM (UTC)

Projects

1 hr / week

Async content

1 hr / week

Testimonials

- "Eugene is a learning machine, and when combined with his years of investing experience, you get access to his repository of hundreds of companies and knowledge. I have greatly benefited from Eugene's time & advice during my investment journey. Likewise, participants will learn lots on analysing, recognising good businesses, & managing risk."

Thomas Chua

Founder, Steady Compounding - "Eugene's dedication & fire towards investing in growth companies that are changing the world, will infect you and change the way you view your investments. You'll not only be a better investor, but a better person. I can think of no one else who wows me as much with his discipline and consistency when it comes to the art and science of investing."

Dawn Cher

SG Budget Babe, Singapore's #1 Female Financial Lifestyle Blogger - "Eugene is one of the sharpest investors I’ve met. He has a knack for finding highly innovative companies with bright long-term growth prospects and he has the right discipline and temperament to invest in these companies for the long haul. Impressed with his ability to find these growth companies from a wide variety of industries."

Chong Ser Jing

Portfolio Manager & Co-Founder of Compounder Fund - "I admire Eugene for his rigour and work that he puts into every stock analysis while consistently following new business developments - always learning, always refining his thoughts. By listening to him, you will gain from his hours of dedicated learning, curated and distillation of the most important points."

Chin Hui Leong

Co-Founder at The Smart Investor

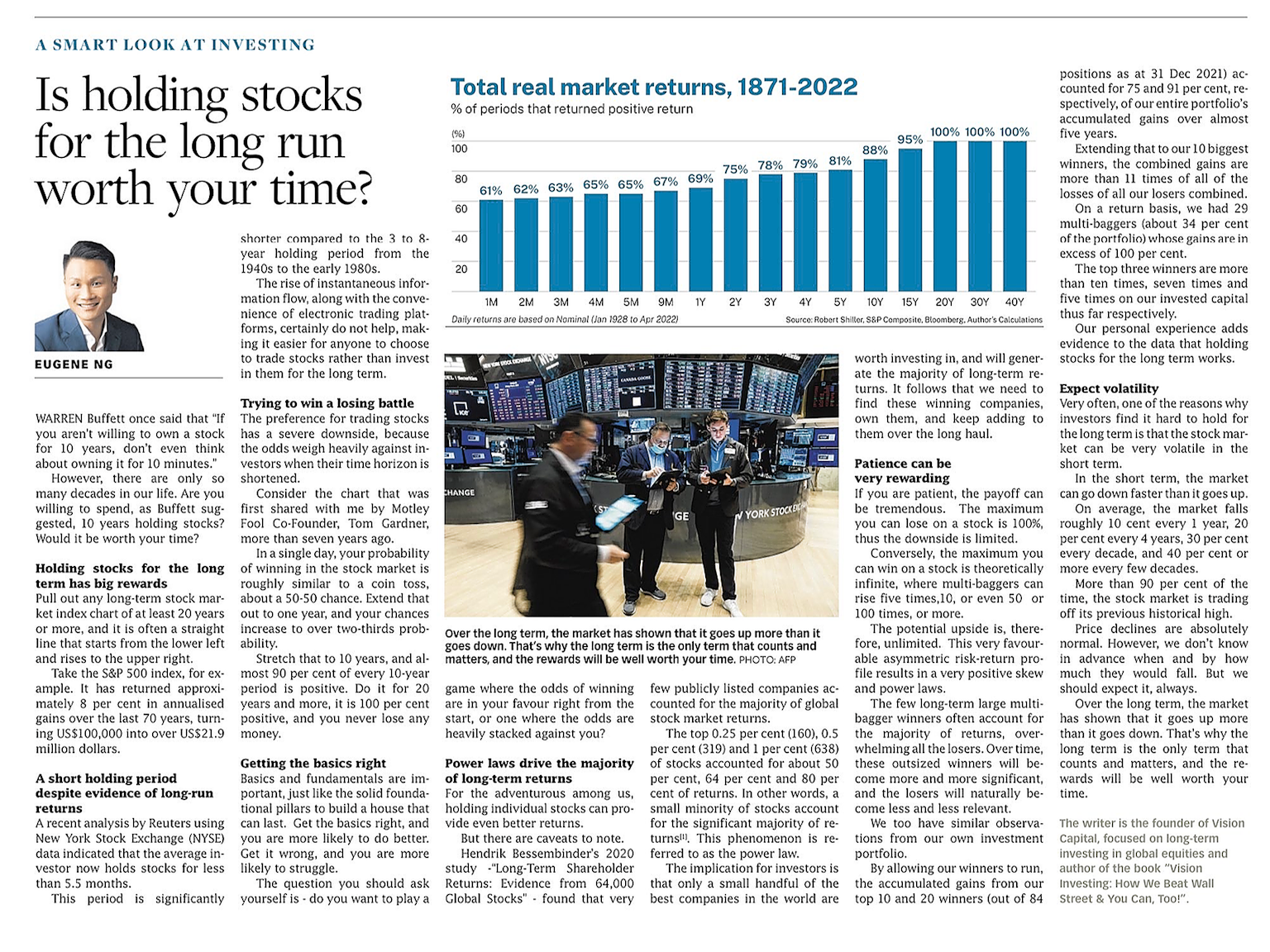

Writing for The Business Times Singapore

Detailed Course Syllabus

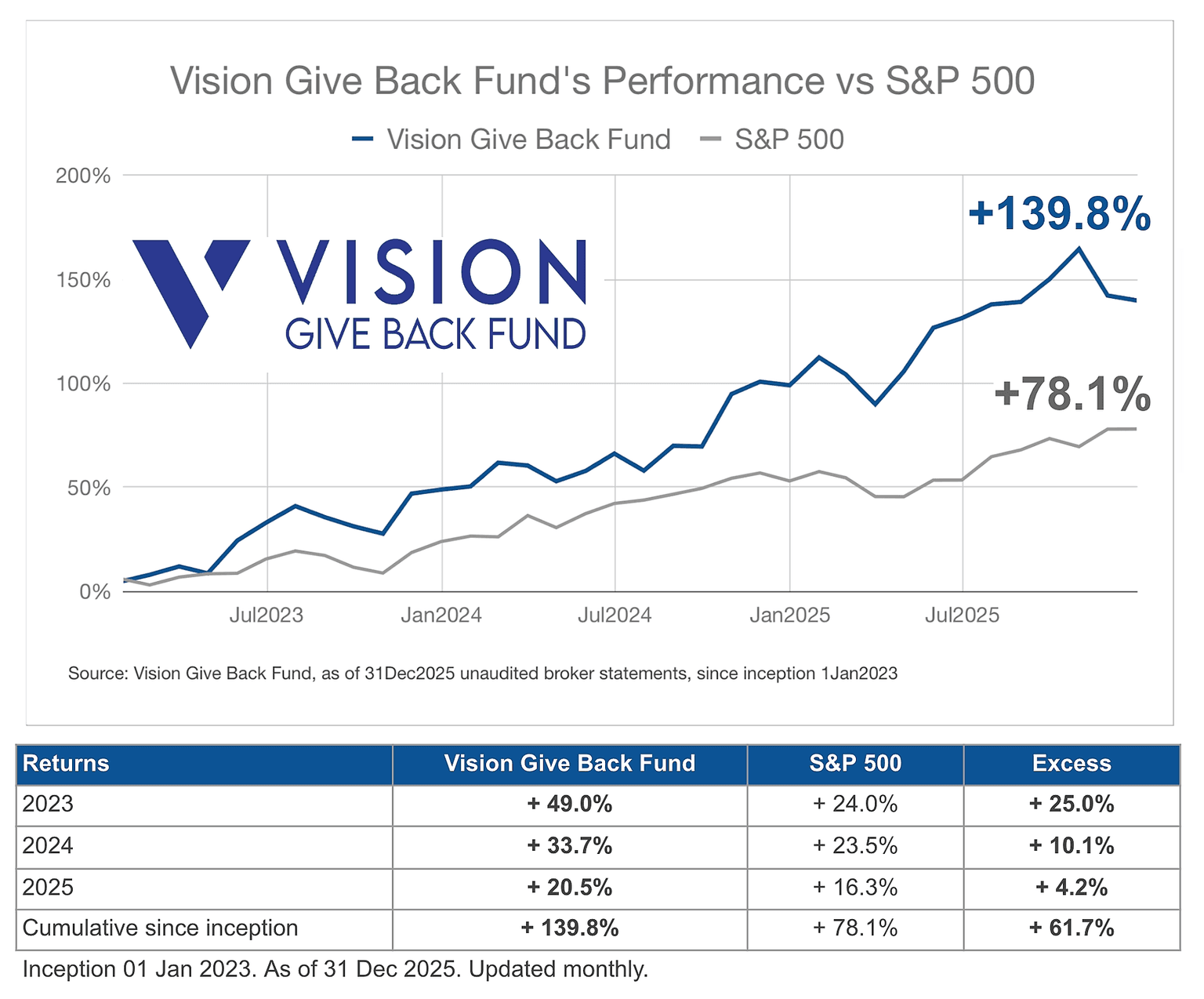

Vision Capital's Outperformance

Source: Vision Capital (as of Jun 2024)

Testimonials from Previous Cohorts

.png&w=1536&q=75)

.png&w=1536&q=75)

Learn to invest better and give back.

100% of net proceeds are invested in Vision Give Back Fund, and 20% of annual gains are donated.

Frequently asked questions